Wouldn’t it be great to have some indicators in advance long before you burn an insane amount of moneythrough team building, product development and marketing.

Is that possible?

Yes and no.

You can never be certain in advance, if a startup will be successful. It depends on a variety of parameters such as team, competition, fundraising abilities and sometimes it’s just coincidences: Meeting the right person at the right time can be crucial for success.

Conversely, you can see early on if the startup or business idea will not be successful. A majority of founders keep on riding on a dead horse. They craft a value proposition, a user journey, an MVP and only realize when the solution is live that they have been riding the dead horse for too long and that it will never work the way they had imagined.

But how is this possible? Everyone does market research before starting a venture, or don’t they?

Yes, and no.

There are things that are really expensive.

There are things that are really expensive if you don’t do them.

There are things that are really expensive if you don’t do them right.

The market validation of a business model is a proud member of the third group.

Almost every founders team, talks about their idea and asks for optimization suggestions or even sometimes quantitative values. Nearly all of them return with bright eyes: “We’ve received very positive feedback.” There are many reasons why this is the case. Unfortunately, the majority of startups still fails. One of the most important facts is the market validation of the business model had been conducted properly. The results of the market research efforts can provide a hint of that. I know many founders who have closed their venture because the venture team fell apart or never found a common ground. Because the development didn’t work out or because no financing was found.

But I don’t remember any conversation in which a founder said, “We had a cool team, a little bit of money, but in the market validation of our project we got such clear, devastatingly negative feedback that we gave up. So if during validating the market the outcome is there is no threat or doubt on the project, it almost always is no real qualification.

What is market validation anyway? A quick and cheap test of hypotheses for product and business model linked to the market.

And then what do the founders do wrong? Here are what I consider to be the five most expensive mistakes made when validating a business model.

1. CO-IDEATION INSTEAD OF TESTING

Especially in the early stages, many founders talk to all kinds of people about their idea and generate valuable ideas. This phase is essential in ideation. But it is even more important to realize that these conversations have no immediate value in predicting future market success. Most open-minded contacts prefer ideas they contributed to. In order to really test an idea on its validity you need a clear definition of the product or service and shouldn’t be influenced by Of course, most open-minded contacts prefer ideas to which they contribute. To really test the interviewee. It is crucial to stick to your idea, and test with people from your target group, not to people who support you.

2. TALK INSTEAD OF CLICK, SOFT INSTEAD OF HARD TESTS

Many founders are deeply convinced of their idea. They pushed their startup against considerable resistance in their own environment. They consider their business idea as their baby and protect it while testing the overall model. Sometimes they simply need great results for a presentation to investors or stakeholders. They run soft tests asking questions. Hard tests, on the other hand, bring the result on how the add works, what is the click-through rate or the amount raised through crowdfunding. Sometimes the results hurt, when you realize nobody clicked on your add or your crowdfunding campaign remained with a result of just 2,100 EUR. These results can be reproduced in later productive settings. Another testing method is blind testing. You test your product together with an established solution in the same area and try to find out if your product outdoesother similar products in the same target group. If so, why? In which categories? If no, why not?

3. THE QUESTIONS IN THE TEST CANNOT VALIDATE CENTRAL HYPOTHESES FOR THE STARTUP.

Counterintuitive, but unfortunately true: answering the question “What do you think?” does not validate a startup’s hypothesis. I don’t need people to like an idea, product, design, or prototype. But rather people who buy or use something. Before I do a test, I need to articulate the central hypotheses I want to test. E.g. “Target group X has problem Y”, “My product solves it”, “My buyers are willing to pay n EUR per month for it” or “m% would buy product k online”.

4. FOCUS ON YOUR OWN PRODUCT, NOT ON THE CUSTOMER’S PROBLEMS.

In many early-stage startup tests, you present a product. Show a prototype or run a task-based test on different user journeys. Sometimes a product-focused test is useful, for product categories where the demand dimension is clear and consumers decide primarily based on taste. Clothing. Beer. Soap. Games. Most products from startups, however, don’t fall into these categories. They are platforms for X, apps for Y, tools for Z, which claim to solve a problem or provide a clearly defined benefit.

The central task of a test should be to understand the mindset of a user who is asking for a digital or physical product: What exactly is his desire, his goal, his task? How does he use products in my category? Why is something a problem? How often does it occur? How serious is it? Why is there no solution yet? Exactly what benefit does my product generate? Often the new innovative service or product provide solutions to a problem no one has or needs to be solved. Unfortunately, often this aspect is neglected in the market research of the founders team, since nobody asks about the applicability in the particular target group. .

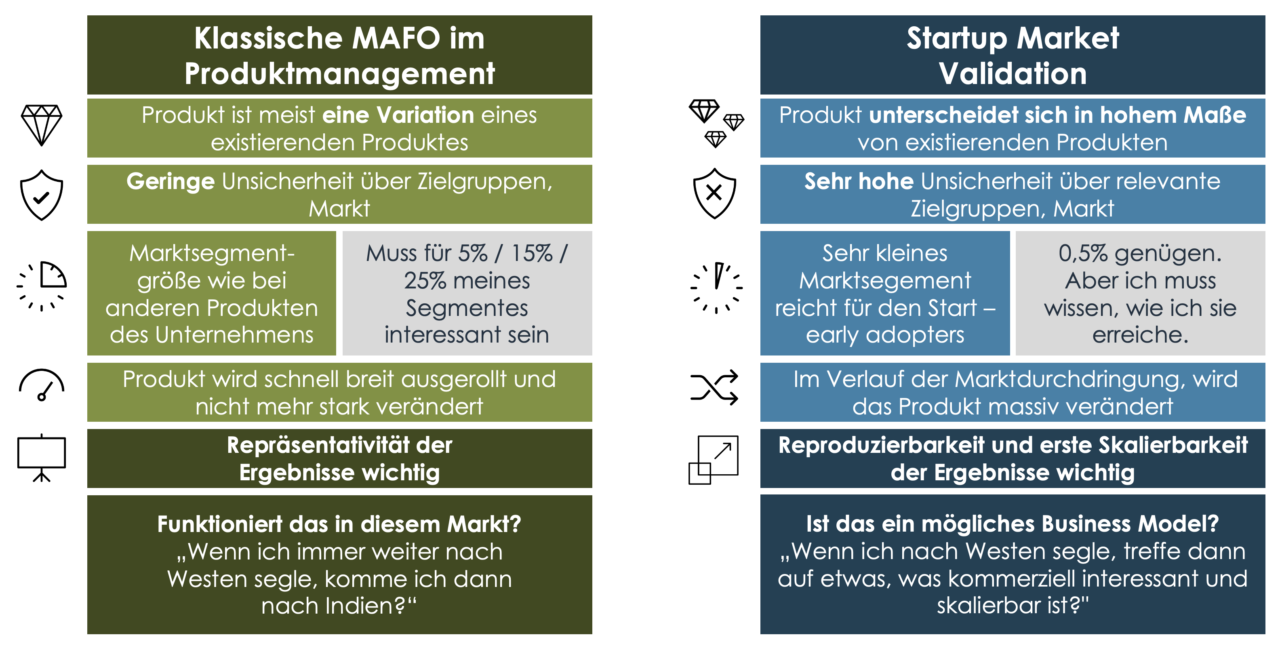

5. CLASSIC MARKET RESEARCH SETUPS INSTEAD OF MARKET VALIDATION.

When it comes to larger tests, many founders are guided by classic methods of quantitative market research; for example, they pay attention to polishing their results to make them more representational.

This is true if I publicize a hair care product via mass media and then put it on the shelves of discount stores. But this form of distribution is typically not the business model for startups.

The question for early-stage startups is rather whether I can find a reasonably large group of early adopters who want to use my product (at a certain price). My result doesn’t need to be representative, but replicable and scalable: What is a good way to reach a group that is likely to buy my product at a certain price?

For example, if you found out during a test that with a certain campaign setting you reach precisely targeted love-hungry Vikings who are willing to buy my hair care product for 80 EUR a bottle to get this irresistible bronze shimmer in their beards, it’s not a valid and replicable result. Since 50 Vikings are not enough. If it was a target group of 5000 it was more likely to scale.

So what? How do I get a more valid market validation?

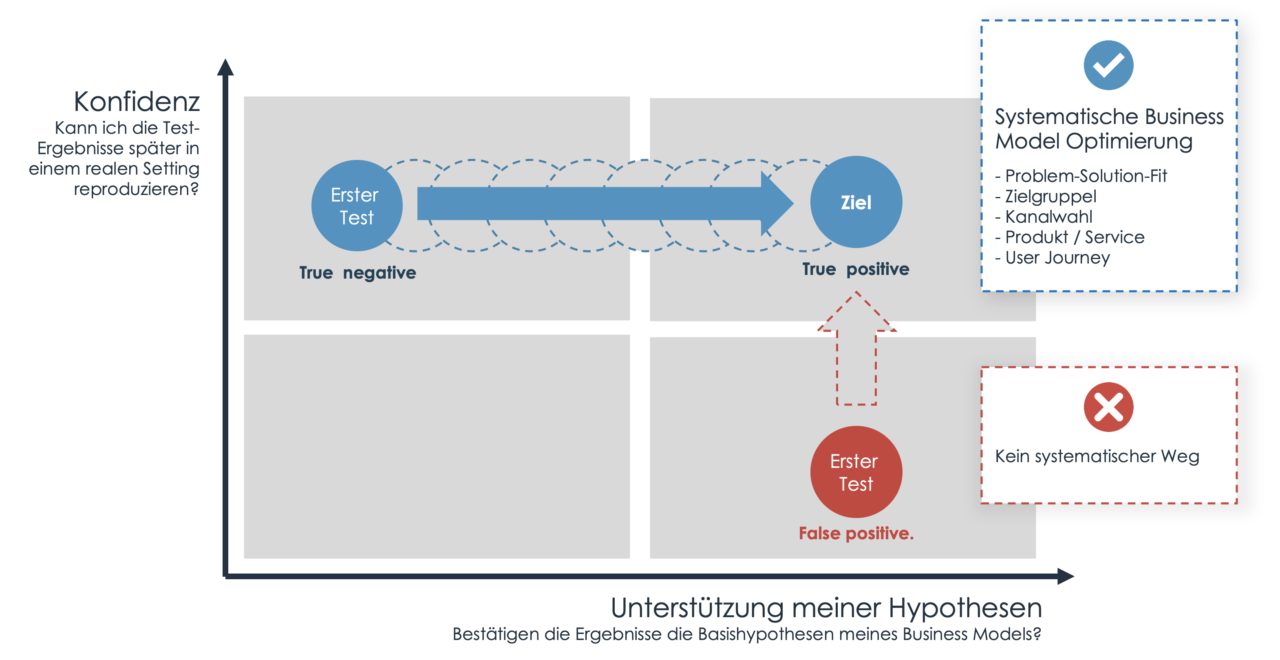

Many founders opt for test setups that support their hypotheses but have low confidence: The test results are difficult to transfer to reality (Chart 2, red circle). They rather would like their idea approved, than to be challenged.

It is essential to challenge your idea right from the start and take the stony path, to create replicable and scalable ideas very early. Further this method allows you to improve the business model, to be tested, to improve, to be tested all the way to the greatest product or service.

I will explore further on how to set up a test for market validation in a follow-up post.